Equated Monthly Installments (EMIs) are a crucial aspect of home loans, representing the fixed amount that borrowers must pay to lenders each month until the loan is fully repaid. The EMI comprises both principal and interest components, which are calculated based on the loan amount, interest rate, and tenure. Understanding how EMIs work is essential for prospective homeowners, as it directly impacts their monthly budget and overall financial health.

The formula for calculating EMIs involves the principal amount, the interest rate, and the loan tenure, which can be expressed mathematically as: \[ EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n – 1} \] where \( P \) is the principal loan amount, \( r \) is the monthly interest rate, and \( n \) is the number of monthly installments. This formula highlights how even small changes in interest rates or loan tenure can significantly affect the EMI amount. Moreover, EMIs are not static; they can fluctuate based on changes in interest rates, especially if the loan is linked to a floating interest rate.

Borrowers must be aware of this dynamic nature of EMIs, as it can lead to increased financial strain if rates rise unexpectedly. Understanding the components of EMIs allows borrowers to make informed decisions about their home loans, including choosing between fixed and floating rates, which can have long-term implications on their financial stability.

Impact of Interest Rate Hikes on Home Loan EMIs

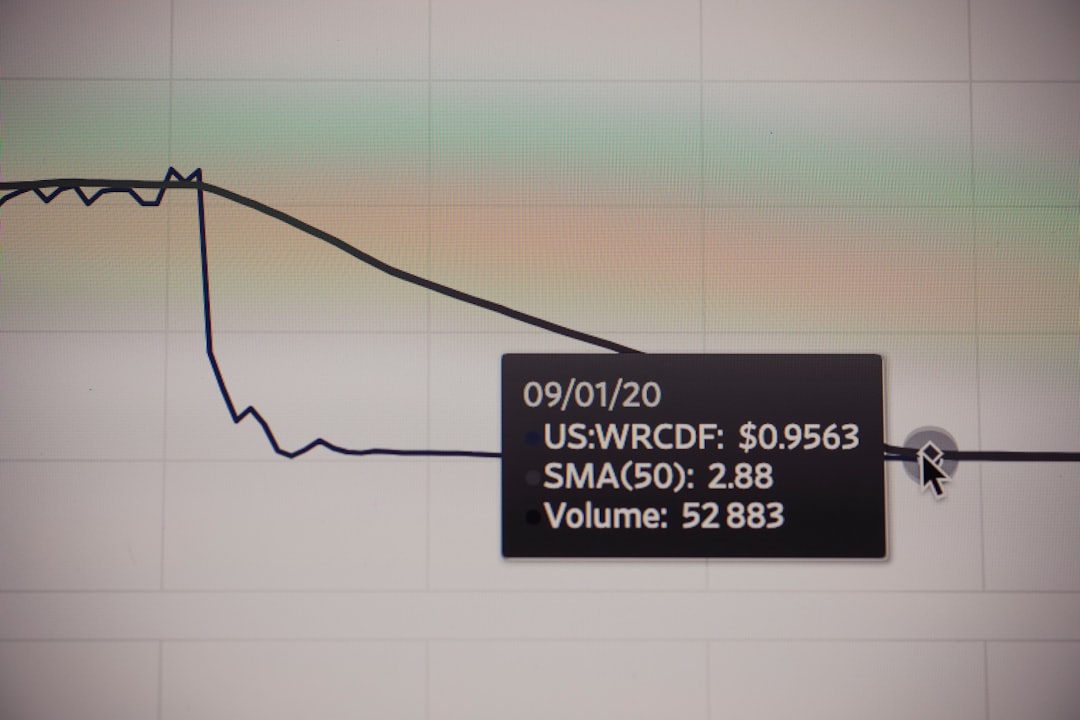

Interest rate hikes can have a profound impact on home loan EMIs, often leading to increased monthly payments for borrowers. When central banks raise interest rates to combat inflation or stabilize the economy, lenders typically follow suit by increasing their lending rates. This change directly affects borrowers with floating-rate loans, as their EMIs will rise in accordance with the new interest rates.

For instance, if a borrower has a home loan of $300,000 at an interest rate of 3% for 30 years, their EMI would be approximately $1,265. However, if the interest rate increases to 4%, the EMI would jump to around $1,432, resulting in an additional financial burden of $167 per month. The implications of rising EMIs extend beyond immediate cash flow concerns; they can also affect borrowers’ long-term financial planning.

Higher EMIs may force homeowners to adjust their budgets, potentially leading to reduced spending in other areas such as savings or discretionary expenses. In some cases, borrowers may find themselves in a position where they can no longer afford their monthly payments, leading to defaults or foreclosures. This scenario underscores the importance of understanding how interest rate fluctuations can impact overall financial health and the necessity for proactive financial management.

Strategies for Managing Home Loan EMIs During Interest Rate Hikes

As interest rates rise and EMIs increase, borrowers must adopt effective strategies to manage their home loan payments. One approach is to reassess and adjust personal budgets to accommodate higher EMIs. This may involve cutting back on non-essential expenses or reallocating funds from other areas of spending.

For example, a family might decide to reduce dining out or entertainment expenses to ensure they can meet their mortgage obligations without compromising their financial stability. Another strategy involves making extra payments towards the principal amount whenever possible. By doing so, borrowers can reduce the outstanding balance on their loans more quickly, which in turn lowers the total interest paid over the life of the loan.

Even small additional payments can have a significant impact; for instance, if a borrower makes an extra payment of $100 each month towards a $200,000 loan at 4% interest over 30 years, they could save thousands in interest and pay off the loan several years earlier. This proactive approach not only alleviates some of the pressure from rising EMIs but also contributes to long-term financial health.

Refinancing Options for Home Loan EMIs

| Refinancing Options for Home Loan EMIs | |||

|---|---|---|---|

| Interest Rate | Loan Term | Monthly EMI | Total Interest Paid |

| 3.5% | 20 years | 1,200 | 80,000 |

| 3.0% | 15 years | 1,500 | 60,000 |

| 4.0% | 30 years | 1,000 | 100,000 |

Refinancing presents an opportunity for borrowers to manage their home loan EMIs more effectively, especially during periods of rising interest rates. By refinancing, homeowners can replace their existing mortgage with a new one that may offer better terms or lower interest rates. For instance, if a borrower initially secured a home loan at a higher interest rate but later finds a lender offering a lower rate due to improved credit scores or market conditions, refinancing could lead to significant savings on monthly payments.

However, refinancing is not without its costs and considerations. Borrowers should evaluate closing costs associated with refinancing, which can include application fees, appraisal fees, and other charges that may offset potential savings. It’s essential to conduct a thorough cost-benefit analysis before proceeding with refinancing.

For example, if refinancing results in a lower EMI but incurs high closing costs that take years to recoup through savings, it may not be a prudent financial decision.

Budgeting for Increased Home Loan EMIs

Effective budgeting becomes paramount when faced with increased home loan EMIs due to rising interest rates. Homeowners should create a detailed budget that accounts for all sources of income and expenses while factoring in the new EMI amounts. This process often involves revisiting fixed and variable expenses to identify areas where cuts can be made without sacrificing essential needs.

For instance, individuals might consider consolidating debts or negotiating better terms on existing loans to free up cash flow for their mortgage payments. Additionally, setting aside an emergency fund specifically for housing-related expenses can provide a safety net during times of financial strain. By proactively managing their budgets and anticipating potential increases in EMIs, homeowners can mitigate the impact of rising interest rates on their overall financial well-being.

Seeking Professional Advice for Managing Home Loan EMIs

Navigating the complexities of home loans and EMIs can be challenging, particularly during periods of economic uncertainty marked by fluctuating interest rates. Seeking professional advice from financial advisors or mortgage specialists can provide valuable insights tailored to individual circumstances. These professionals can help borrowers understand their options regarding refinancing, budgeting strategies, and long-term financial planning.

Moreover, financial advisors can assist in evaluating the overall impact of rising interest rates on personal finances and suggest personalized strategies for managing debt effectively. For example, they may recommend diversifying investments or exploring alternative income streams to bolster cash flow during challenging times. Engaging with professionals ensures that borrowers are well-informed and equipped to make sound financial decisions regarding their home loans.

Preparing for Future Interest Rate Changes

Anticipating future interest rate changes is crucial for homeowners looking to manage their home loan EMIs effectively. Economic indicators such as inflation rates, employment statistics, and central bank policies can provide insights into potential shifts in interest rates. By staying informed about these factors, borrowers can better prepare for possible increases in their monthly payments.

One proactive measure is to consider locking in fixed-rate mortgages when market conditions are favorable. Fixed-rate loans provide stability against future rate hikes by ensuring that monthly payments remain constant throughout the loan term. Additionally, homeowners should regularly review their financial situations and adjust their strategies accordingly as market conditions evolve.

This ongoing assessment allows borrowers to remain agile in response to changing economic landscapes.

Long-term Financial Planning for Home Loan EMIs

Long-term financial planning is essential for managing home loan EMIs effectively over time. Homeowners should consider how their mortgage fits into their broader financial goals, including retirement planning and wealth accumulation strategies. Establishing clear objectives—such as paying off the mortgage before retirement or building equity in property—can guide decision-making regarding home loans.

Furthermore, diversifying investments beyond real estate can provide additional financial security and flexibility when managing EMIs. For instance, investing in stocks or bonds may yield returns that help offset increased mortgage payments during periods of rising interest rates. By integrating home loan management into a comprehensive financial plan, borrowers can navigate challenges more effectively while working towards long-term stability and growth in their financial lives.

FAQs

What is an interest rate hike?

An interest rate hike refers to an increase in the cost of borrowing money, typically set by a central bank or other monetary authority.

How do interest rate hikes affect home loan EMIs?

Interest rate hikes can lead to an increase in the EMIs (Equated Monthly Installments) for home loans. This is because higher interest rates result in higher borrowing costs, leading to an increase in the monthly repayment amount.

Why do interest rate hikes affect home loan EMIs?

Interest rate hikes affect home loan EMIs because they increase the cost of borrowing for the lender, which is then passed on to the borrower in the form of higher EMIs.

Are there any ways to mitigate the impact of interest rate hikes on home loan EMIs?

Borrowers can consider refinancing their home loans to lock in a lower interest rate before a hike occurs. Additionally, opting for a fixed-rate home loan instead of a floating-rate loan can provide protection against interest rate hikes.

How can borrowers prepare for potential interest rate hikes affecting their home loan EMIs?

Borrowers can prepare for potential interest rate hikes by budgeting for higher EMIs, building an emergency fund to cover any unexpected increases, and staying informed about market trends and potential rate changes.