Mutual fund fact sheets serve as essential tools for investors seeking to understand the intricacies of various mutual funds. These documents provide a concise overview of a fund’s objectives, performance, and key characteristics, enabling potential investors to make informed decisions. Typically, a fact sheet is a one or two-page document that summarizes critical information about a mutual fund, including its investment strategy, historical performance, and risk factors.

The importance of these fact sheets cannot be overstated, as they distill complex financial data into an accessible format that can be easily understood by both novice and experienced investors alike. The structure of a mutual fund fact sheet is designed to facilitate quick comparisons between different funds. Investors can assess various metrics at a glance, such as performance over different time frames, asset allocation, and fees.

This streamlined presentation allows individuals to evaluate whether a particular fund aligns with their investment goals and risk tolerance. Furthermore, the fact sheet often includes visual aids like charts and graphs, which can enhance comprehension and retention of the information presented. In an era where financial literacy is increasingly vital, mutual fund fact sheets play a crucial role in empowering investors to navigate the complexities of the investment landscape.

Performance Metrics and Ratios

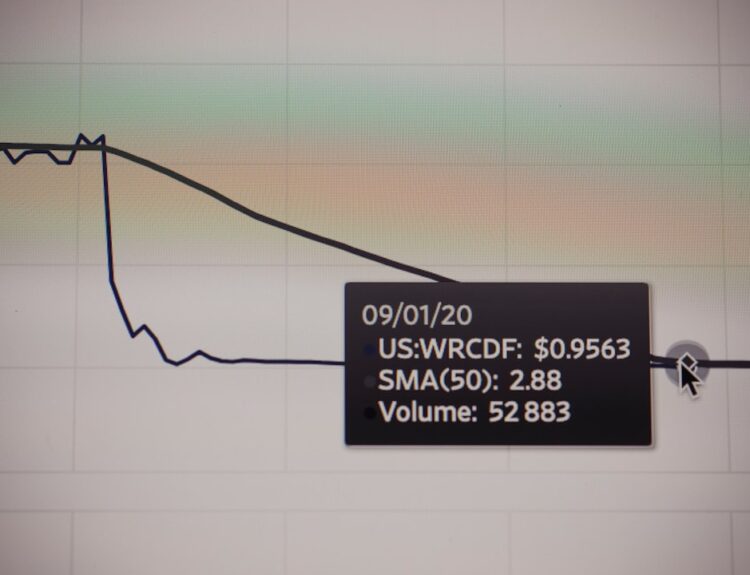

Performance metrics and ratios are fundamental components of mutual fund fact sheets, providing insights into how well a fund has performed relative to its benchmarks and peers. Commonly featured metrics include total return, which reflects the overall gain or loss of an investment over a specified period, typically expressed as a percentage. This figure is crucial for investors as it encapsulates not only price appreciation but also any income generated from dividends or interest.

Additionally, annualized returns are often presented, allowing investors to gauge the fund’s performance on a yearly basis over multiple years. Another important ratio found in mutual fund fact sheets is the Sharpe ratio, which measures risk-adjusted return. This ratio helps investors understand how much excess return they are receiving for the additional volatility they are taking on compared to a risk-free asset.

A higher Sharpe ratio indicates that the fund has provided better returns for each unit of risk taken, making it an attractive option for risk-conscious investors. Other ratios such as the alpha and beta also provide valuable insights; alpha measures the fund’s performance relative to its benchmark after adjusting for risk, while beta indicates the fund’s volatility in relation to the market. Together, these metrics create a comprehensive picture of a fund’s performance and risk profile.

Investment Holdings and Portfolio Composition

The investment holdings and portfolio composition section of a mutual fund fact sheet offers a detailed look at the assets within the fund. This section typically lists the top holdings, which are the individual securities that make up the largest portions of the fund’s portfolio. For instance, a technology-focused mutual fund may prominently feature stocks from major companies like Apple, Microsoft, or Google.

Understanding these holdings is crucial for investors as it provides insight into the sectors and industries that the fund is exposed to, allowing them to assess whether these align with their investment philosophy. In addition to individual holdings, fact sheets often include information about the overall asset allocation of the fund. This may encompass percentages allocated to various asset classes such as equities, fixed income, cash equivalents, or alternative investments.

For example, a balanced mutual fund might allocate 60% to stocks and 40% to bonds, reflecting a moderate risk profile aimed at capital appreciation while also providing some income stability. By examining this composition, investors can determine if the fund’s strategy aligns with their own risk tolerance and investment objectives. Furthermore, diversification within the portfolio can mitigate risks associated with individual securities or sectors, making this information vital for prudent investment decisions.

Fund Manager Information

| Fund Manager | Experience (years) | Total Assets Managed (in millions) |

|---|---|---|

| John Smith | 15 | 500 |

| Emily Johnson | 10 | 300 |

| Michael Brown | 20 | 800 |

The expertise and track record of the fund manager play a pivotal role in the success of a mutual fund. The fund manager information section of a fact sheet typically includes details about the individual or team responsible for making investment decisions on behalf of the fund. This may encompass their professional background, years of experience in asset management, and any notable achievements or awards received during their career.

For instance, if a fund manager has consistently outperformed their benchmark over several years, this can instill confidence in potential investors regarding their ability to navigate market fluctuations effectively. Moreover, understanding the investment philosophy and strategy employed by the fund manager is equally important. Some managers may adopt an active management approach, seeking to outperform market indices through stock selection and market timing.

Others may follow a passive strategy, aiming to replicate the performance of a specific index by investing in its constituent securities. The fact sheet may also highlight any changes in management or investment strategy that could impact future performance. Investors should consider not only the past performance of the manager but also their approach to risk management and how they adapt to changing market conditions.

Expense Ratios and Fees

Expense ratios and fees are critical factors that can significantly impact an investor’s overall returns from a mutual fund. The expense ratio represents the annual cost of managing the fund expressed as a percentage of its average net assets. This figure encompasses various costs such as management fees, administrative expenses, and other operational costs associated with running the fund.

A lower expense ratio is generally more favorable for investors since high fees can erode returns over time. For example, if two funds achieve identical returns but one has an expense ratio of 1% while the other is 0.5%, the latter will ultimately yield higher net returns for investors. In addition to expense ratios, mutual fund fact sheets often disclose other fees that may apply to investors.

These can include sales loads (front-end or back-end), redemption fees for selling shares within a certain timeframe, and account maintenance fees. Understanding these costs is essential for investors as they can vary widely between funds and impact overall investment performance. For instance, actively managed funds tend to have higher expense ratios due to the costs associated with research and active trading strategies compared to passively managed index funds.

By carefully reviewing these fees outlined in the fact sheet, investors can make more informed choices that align with their financial goals.

Risk and Volatility Measures

Risk and volatility measures are integral components of mutual fund fact sheets that help investors assess potential downsides associated with their investments. One common measure is standard deviation, which quantifies how much a fund’s returns deviate from its average return over time. A higher standard deviation indicates greater volatility, suggesting that the fund’s returns can fluctuate significantly from year to year.

For instance, an equity mutual fund may exhibit higher standard deviation compared to a bond fund due to the inherent risks associated with stock investments. Another important metric is downside risk, which specifically focuses on potential losses during periods of market downturns. This measure helps investors understand how much they could potentially lose if market conditions worsen.

Additionally, fact sheets may include value-at-risk (VaR), which estimates the maximum potential loss over a specified time frame at a given confidence level. By analyzing these risk measures alongside performance metrics, investors can gain a clearer understanding of how much risk they are willing to accept in pursuit of their investment objectives.

Distribution and Dividend Information

Distribution and dividend information is another key aspect highlighted in mutual fund fact sheets that can significantly influence an investor’s decision-making process. Many mutual funds distribute income generated from dividends or interest payments on a regular basis—typically quarterly or annually—providing investors with a source of income in addition to capital appreciation. The fact sheet will often specify the distribution yield, which represents the annual income distributed as a percentage of the fund’s net asset value (NAV).

For income-focused investors or retirees seeking regular cash flow, this information is particularly relevant. Furthermore, some funds may have specific policies regarding reinvestment options for dividends received by shareholders. Investors can choose to reinvest dividends back into additional shares of the fund or receive them as cash payments.

Understanding these options allows investors to tailor their investment strategy according to their financial needs and preferences. Additionally, fact sheets may provide historical distribution data, giving insight into how consistent or variable distributions have been over time—an important consideration for those relying on these distributions for living expenses or other financial obligations.

Additional Resources and Disclosures

The final section of mutual fund fact sheets often includes additional resources and disclosures that provide further context for potential investors. This may encompass links to more detailed reports such as prospectuses or annual reports that offer comprehensive insights into the fund’s operations and strategies. These documents typically contain extensive information about risks associated with investing in the fund, including market risks, credit risks, and liquidity risks that could affect performance.

Moreover, regulatory disclosures mandated by governing bodies such as the Securities and Exchange Commission (SEC) are also included in this section. These disclosures ensure transparency regarding any potential conflicts of interest or material changes in management or investment strategy that could impact investor decisions. By reviewing these additional resources and disclosures provided in mutual fund fact sheets, investors can deepen their understanding of the funds they are considering and make more informed choices aligned with their financial goals and risk tolerance levels.

In summary, mutual fund fact sheets are invaluable tools that encapsulate essential information about various funds in an accessible format. By examining performance metrics, portfolio composition, manager information, fees, risk measures, distribution details, and additional resources provided in these documents, investors can navigate their investment choices with greater confidence and clarity.

FAQs

What is a mutual fund fact sheet?

A mutual fund fact sheet is a document provided by mutual fund companies that contains key information about a particular mutual fund, including its investment objectives, performance, fees, and holdings.

What information can be found in a mutual fund fact sheet?

A mutual fund fact sheet typically includes information such as the fund’s investment objective, performance data, expense ratios, top holdings, asset allocation, and other key metrics that can help investors make informed decisions.

What should I check in a mutual fund fact sheet before investing?

Before investing in a mutual fund, it is important to check the fund’s investment objective, performance over different time periods, expense ratios, top holdings, asset allocation, and any other relevant information that aligns with your investment goals and risk tolerance.

How can I use a mutual fund fact sheet to make investment decisions?

By reviewing a mutual fund fact sheet, investors can compare different funds, assess their performance, understand their fees, and evaluate their risk levels. This information can help investors make informed decisions about which mutual fund aligns with their investment objectives and risk tolerance.

Where can I find a mutual fund fact sheet?

Mutual fund fact sheets are typically available on the websites of mutual fund companies, as well as through financial advisors, brokerage firms, and other financial institutions that offer mutual fund investments.