Robo-advisors are automated platforms that provide financial planning services with minimal human intervention. They utilize algorithms and software to manage investment portfolios based on individual client profiles, which include factors such as risk tolerance, investment goals, and time horizon. The rise of robo-advisors has democratized access to investment management, allowing individuals who may not have the capital to engage traditional financial advisors to receive tailored investment advice.

This technology-driven approach has gained traction particularly among millennials and younger investors who are more comfortable with digital solutions. The concept of robo-advisors emerged in the late 2000s, coinciding with advancements in technology and a growing demand for low-cost investment options. Companies like Betterment and Wealthfront were among the pioneers in this space, offering services that combined algorithmic trading with user-friendly interfaces.

Today, a plethora of robo-advisors exist, each with unique features and investment strategies, catering to a diverse range of investors. The appeal lies not only in their cost-effectiveness but also in their ability to provide a level of personalization that was previously reserved for high-net-worth individuals.

How do Robo-Advisors Work?

Robo-advisors operate through a systematic process that begins with an initial client assessment. When a user signs up for a robo-advisor service, they typically complete a questionnaire designed to gauge their financial situation, investment experience, risk tolerance, and future goals. This information is crucial as it informs the algorithm on how to allocate assets effectively.

Based on the responses, the robo-advisor creates a customized investment portfolio that aligns with the client’s preferences and objectives. Once the portfolio is established, the robo-advisor manages it through automated rebalancing and tax-loss harvesting strategies. Rebalancing involves adjusting the asset allocation back to its original state when market fluctuations cause it to drift.

Tax-loss harvesting is a strategy where the advisor sells securities at a loss to offset capital gains taxes on other investments. These processes are executed without requiring direct input from the investor, allowing for a hands-off approach to portfolio management. Additionally, many robo-advisors offer features such as automatic contributions and goal tracking, further enhancing the user experience.

The Reliability of Robo-Advisors

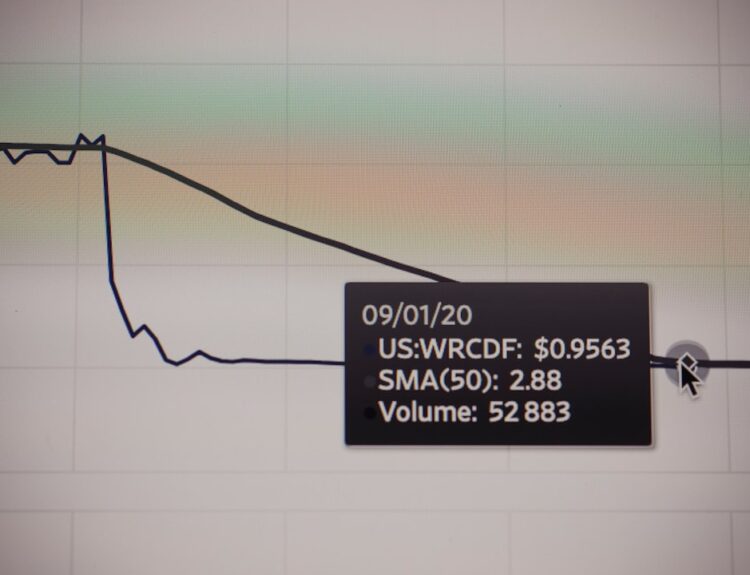

The reliability of robo-advisors is often scrutinized, particularly regarding their ability to navigate volatile markets and provide sound financial advice. While these platforms are built on sophisticated algorithms that analyze vast amounts of data, they are not infallible. Market conditions can change rapidly, and algorithms may not always account for unforeseen events or shifts in economic indicators.

However, many robo-advisors employ advanced machine learning techniques that allow them to adapt their strategies based on historical data and emerging trends. Moreover, the regulatory environment surrounding robo-advisors adds a layer of reliability. Most robo-advisors are registered with regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States, which imposes strict guidelines on their operations.

This oversight ensures that these platforms adhere to fiduciary standards, meaning they are obligated to act in the best interests of their clients. Additionally, many robo-advisors partner with established financial institutions to provide custodial services, further enhancing their credibility and reliability.

Benefits of Using Robo-Advisors

| Benefits of Using Robo-Advisors |

|---|

| 1. Low fees compared to traditional financial advisors |

| 2. Access to diversified investment portfolios |

| 3. Automated portfolio rebalancing |

| 4. Convenient and easy to use |

| 5. Lower account minimums for investment |

| 6. Personalized investment advice based on goals and risk tolerance |

One of the most significant benefits of using robo-advisors is their cost-effectiveness. Traditional financial advisors often charge fees that can range from 1% to 2% of assets under management (AUM), which can significantly eat into investment returns over time. In contrast, robo-advisors typically charge lower fees, often around 0.25% to 0.50% AUM, making them an attractive option for cost-conscious investors.

This lower fee structure allows individuals to retain more of their investment gains, which can compound over time. Another advantage is the accessibility that robo-advisors provide. Many platforms have low or no minimum investment requirements, enabling individuals from various financial backgrounds to start investing without needing substantial capital upfront.

This democratization of investment management is particularly beneficial for younger investors or those just beginning their financial journeys. Furthermore, the user-friendly interfaces and mobile applications offered by many robo-advisors make it easy for clients to monitor their investments and make adjustments as needed.

Potential Drawbacks of Robo-Advisors

Despite their many advantages, robo-advisors are not without potential drawbacks. One significant concern is the lack of personalized service that comes with human advisors. While algorithms can analyze data and make informed decisions based on established parameters, they may not fully grasp the nuances of an individual’s financial situation or personal preferences.

For instance, life events such as marriage, divorce, or job loss can significantly impact an investor’s strategy, and a human advisor might provide more tailored advice in these situations. Additionally, some investors may feel uncomfortable relying solely on technology for their financial decisions. The absence of face-to-face interaction can lead to feelings of uncertainty or mistrust, particularly for those who prefer a more hands-on approach to managing their finances.

Furthermore, during periods of market volatility or economic downturns, investors may seek reassurance and guidance that a human advisor could provide more effectively than an automated system.

Choosing the Right Robo-Advisor for You

Selecting the right robo-advisor involves careful consideration of several factors that align with your financial goals and preferences. First and foremost, assess the fee structure of various platforms; while lower fees are generally preferable, it’s essential to understand what services are included in those fees. Some robo-advisors may offer additional features such as tax-loss harvesting or personalized financial planning tools that could justify higher costs.

Another critical aspect is the investment strategy employed by the robo-advisor. Different platforms may focus on various asset classes or employ distinct approaches to portfolio management. For example, some may prioritize socially responsible investing (SRI) or environmental, social, and governance (ESG) criteria, while others may take a more traditional approach focused solely on maximizing returns.

Understanding your own values and investment philosophy will help you choose a platform that resonates with your objectives.

The Future of Robo-Advisors

The future of robo-advisors appears promising as technology continues to evolve and reshape the financial landscape. One trend gaining traction is the integration of artificial intelligence (AI) and machine learning into robo-advisor platforms. These advancements could enhance predictive analytics capabilities, allowing for more accurate forecasting of market trends and improved portfolio management strategies.

As AI becomes more sophisticated, it may enable robo-advisors to offer even more personalized advice based on real-time data analysis. Moreover, as consumer preferences shift towards sustainable investing, robo-advisors are likely to expand their offerings in this area. The demand for socially responsible investment options is growing rapidly among younger investors who prioritize ethical considerations alongside financial returns.

Consequently, we can expect more robo-advisors to incorporate ESG factors into their investment strategies and provide clients with options that align with their values.

Tips for Maximizing Your Robo-Advisor Experience

To get the most out of your robo-advisor experience, it’s essential to remain engaged with your investment strategy actively. Regularly reviewing your portfolio’s performance and making adjustments based on changes in your financial situation or market conditions can help ensure that your investments remain aligned with your goals. Many platforms offer tools for tracking performance and setting alerts for significant market movements; utilizing these features can enhance your overall experience.

Additionally, take advantage of any educational resources provided by your chosen robo-advisor. Many platforms offer articles, webinars, or interactive tools designed to help clients better understand investing concepts and strategies. By educating yourself about market trends and investment principles, you can make more informed decisions regarding your portfolio and feel more confident in your investment journey.

In conclusion, while robo-advisors present an innovative solution for modern investors seeking efficient and cost-effective portfolio management, understanding their workings, benefits, drawbacks, and future potential is crucial for making informed decisions about your financial future.

FAQs

What is a robo-advisor?

A robo-advisor is a digital platform that provides automated, algorithm-driven financial planning services with little to no human supervision.

How do robo-advisors work?

Robo-advisors use algorithms to create and manage investment portfolios based on an investor’s financial goals, risk tolerance, and time horizon. They typically offer a low-cost and hands-off approach to investing.

Are robo-advisors reliable?

Robo-advisors can be reliable for certain investors, especially those with straightforward financial situations and long-term investment goals. However, it’s important to carefully research and choose a reputable robo-advisor with a track record of success.