Non-Banking Financial Companies (NBFCs) and banks are integral components of the financial ecosystem, each serving distinct roles while also overlapping in certain areas. Banks are financial institutions that are licensed to accept deposits from the public and provide loans. They are regulated by central banks and must adhere to stringent guidelines regarding capital adequacy, liquidity, and risk management.

Banks offer a wide range of services, including savings and checking accounts, credit cards, mortgages, and investment products. Their primary function is to act as intermediaries between depositors and borrowers, facilitating the flow of funds within the economy. On the other hand, NBFCs are financial entities that provide various banking services but do not hold a banking license.

They cannot accept demand deposits, which means they cannot offer checking accounts or savings accounts that allow for immediate withdrawals. However, NBFCs play a crucial role in providing credit and financial services to sectors that may be underserved by traditional banks. They often focus on specific niches, such as vehicle financing, microfinance, or housing loans.

While they are not subject to the same level of regulatory scrutiny as banks, NBFCs must still comply with regulations set forth by financial authorities, which vary by country.

Differences in Regulation and Supervision

The regulatory framework governing banks is typically more rigorous than that for NBFCs. In many countries, banks are overseen by a central bank or a similar regulatory authority that enforces strict capital requirements, liquidity ratios, and risk management practices. For instance, in the United States, banks must comply with regulations established by the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

These regulations are designed to ensure the stability of the banking system and protect depositors’ interests. In contrast, NBFCs often face less stringent regulatory oversight. While they are still required to register with financial authorities and adhere to certain operational guidelines, the lack of demand deposit acceptance means they are not subject to the same capital adequacy requirements as banks.

This regulatory leniency allows NBFCs to operate with greater flexibility, enabling them to tailor their products and services to meet specific market needs. However, this also raises concerns about consumer protection and financial stability, particularly in times of economic stress when NBFCs may be more vulnerable to liquidity crises.

Types of Loans Offered by NBFCs and Banks

Both banks and NBFCs offer a variety of loan products, but their focus and target markets can differ significantly. Banks typically provide a broad spectrum of loans, including personal loans, home loans, auto loans, business loans, and education loans. They often have the resources to offer competitive interest rates and longer repayment terms due to their access to a larger pool of deposits.

For example, a bank may offer a 30-year mortgage with fixed interest rates, making it an attractive option for homebuyers seeking stability in their monthly payments. NBFCs, on the other hand, often specialize in specific types of loans or cater to niche markets that may be overlooked by traditional banks. For instance, many NBFCs focus on vehicle financing, providing loans for both new and used cars with flexible repayment options tailored to the needs of individual borrowers.

Additionally, some NBFCs concentrate on microfinance, offering small loans to entrepreneurs in rural areas who may lack access to traditional banking services. This specialization allows NBFCs to serve customers who may have limited credit histories or lower income levels, thereby promoting financial inclusion.

Interest Rates and Fees

| Interest Rates and Fees | Lowest Rate | Highest Rate | Annual Fee |

|---|---|---|---|

| Credit Card A | 12% | 18% | 0 |

| Credit Card B | 10% | 20% | 50 |

| Personal Loan A | 5% | 12% | 100 |

| Personal Loan B | 8% | 15% | 0 |

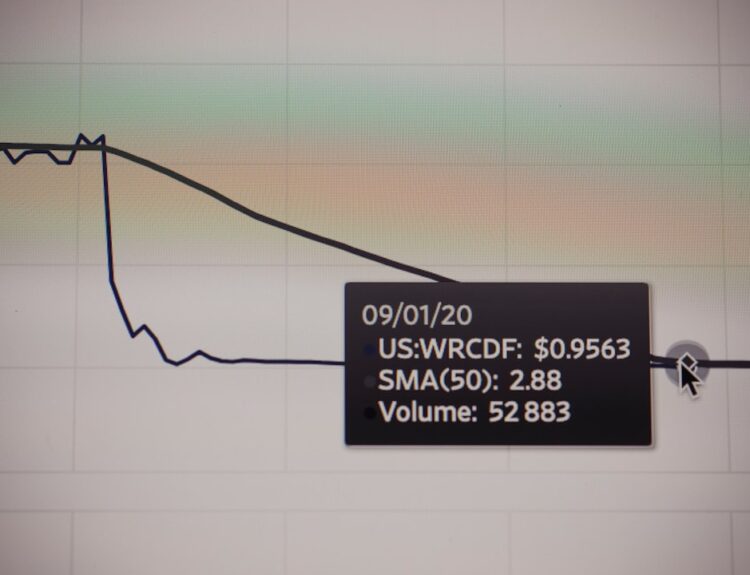

Interest rates and fees associated with loans can vary significantly between banks and NBFCs. Banks generally offer lower interest rates on loans due to their ability to attract deposits at competitive rates. They often have established relationships with customers and can leverage their larger balance sheets to provide favorable terms.

For example, a bank might offer a personal loan at an interest rate of 8% per annum for borrowers with good credit scores. Conversely, NBFCs may charge higher interest rates compared to banks because they rely on alternative funding sources such as commercial paper or debentures rather than customer deposits. This reliance on market-based funding can lead to increased costs that are passed on to borrowers in the form of higher interest rates.

For instance, an NBFC might offer a similar personal loan at an interest rate of 12% per annum. Additionally, NBFCs may impose various fees such as processing fees, prepayment penalties, or late payment charges that can further increase the overall cost of borrowing.

Credit Evaluation and Approval Process

The credit evaluation process is another area where banks and NBFCs diverge significantly. Banks typically employ a comprehensive credit assessment framework that includes detailed analysis of a borrower’s credit history, income verification, employment stability, and debt-to-income ratio. This thorough evaluation process can result in longer approval times for loans as banks seek to mitigate risk by ensuring that borrowers have the capacity to repay their debts.

In contrast, NBFCs often adopt a more flexible approach to credit evaluation. They may place greater emphasis on alternative data sources or non-traditional credit assessments when evaluating potential borrowers. For example, an NBFC might consider factors such as utility bill payments or mobile phone payment history as indicators of creditworthiness for individuals with limited formal credit histories.

This flexibility allows NBFCs to approve loans more quickly and cater to borrowers who may be deemed too risky by traditional banks.

Accessibility and Convenience

Accessibility is a critical factor influencing borrowers’ choices between banks and NBFCs. Banks often have extensive branch networks and digital banking platforms that provide customers with convenient access to their services. Many banks offer online applications for loans, allowing customers to apply from the comfort of their homes without needing to visit a physical branch.

This convenience is particularly appealing for individuals who prefer digital interactions over traditional banking methods. NBFCs also prioritize accessibility but may do so through different channels. Many NBFCs leverage technology to streamline their operations and enhance customer experience.

For instance, some NBFCs have developed mobile applications that allow users to apply for loans, track their application status, and manage repayments seamlessly. Additionally, NBFCs often have more lenient eligibility criteria compared to banks, making it easier for individuals with lower credit scores or limited financial histories to access credit. This focus on accessibility enables NBFCs to reach underserved populations who may struggle to obtain financing through traditional banking channels.

Customer Service and Relationship Management

Customer service plays a pivotal role in shaping borrowers’ experiences with both banks and NBFCs. Banks typically have dedicated customer service departments that handle inquiries related to loans, account management, and other banking services. Larger banks may offer 24/7 customer support through various channels such as phone lines, chatbots, or online messaging systems.

However, due to their size and complexity, some customers may find it challenging to receive personalized attention or timely responses. In contrast, many NBFCs pride themselves on providing personalized customer service tailored to individual needs. Given their smaller scale compared to banks, NBFCs often foster closer relationships with their clients.

This can lead to more responsive service and quicker resolutions for customer inquiries or issues. For example, an NBFC might assign dedicated relationship managers to high-value clients or small business owners who require ongoing support throughout their borrowing journey. This emphasis on relationship management can enhance customer loyalty and satisfaction.

Risk Management and Financial Stability

Risk management practices differ significantly between banks and NBFCs due to their varying regulatory environments and operational models. Banks are required to maintain robust risk management frameworks that encompass credit risk assessment, market risk monitoring, operational risk controls, and liquidity management strategies. These frameworks are essential for ensuring financial stability and protecting depositors’ funds in times of economic uncertainty.

NBFCs face unique challenges in risk management as they operate under different regulatory constraints. While they must implement risk management practices to safeguard their operations, the absence of stringent capital requirements can expose them to higher levels of risk during economic downturns. For instance, if an NBFC experiences a surge in loan defaults due to adverse economic conditions without sufficient capital buffers, it may face liquidity challenges that threaten its viability.

Consequently, effective risk management becomes paramount for NBFCs as they navigate market fluctuations while striving to maintain financial stability. In summary, while both banks and NBFCs play vital roles in providing financial services and facilitating economic growth, they operate under different frameworks that influence their offerings and customer experiences. Understanding these distinctions is crucial for borrowers seeking the most suitable financing options for their needs.

FAQs

What is the difference between NBFC loans and bank loans?

NBFC loans are provided by Non-Banking Financial Companies, while bank loans are provided by traditional banks. NBFCs are not allowed to accept demand deposits, while banks can.

What are the eligibility criteria for NBFC loans and bank loans?

The eligibility criteria for NBFC loans and bank loans may vary, but generally, both require the borrower to have a good credit score, stable income, and the ability to repay the loan.

What are the interest rates for NBFC loans and bank loans?

The interest rates for NBFC loans are usually higher than bank loans, as NBFCs take on higher risk by lending to borrowers who may not meet the strict criteria of traditional banks.

What is the loan processing time for NBFC loans and bank loans?

NBFC loans typically have a faster loan processing time compared to bank loans, as NBFCs have less stringent regulations and paperwork requirements.

What are the types of loans offered by NBFCs and banks?

Both NBFCs and banks offer a variety of loans, including personal loans, home loans, business loans, and vehicle loans. However, the terms and conditions may vary between the two types of lenders.