Debt is a financial obligation that arises when an individual borrows money with the promise to repay it, typically with interest, over a specified period. It can take various forms, including credit card debt, student loans, mortgages, and personal loans. Each type of debt has its own terms and conditions, which can significantly affect an individual’s financial health.

For instance, high-interest credit card debt can quickly spiral out of control if not managed properly, leading to a cycle of borrowing that can be difficult to escape. Conversely, some forms of debt, such as mortgages or student loans, can be considered “good debt” if they contribute to long-term financial growth or career advancement. The impact of debt on one’s financial future cannot be overstated.

High levels of debt can limit an individual’s ability to save for retirement, invest in opportunities, or even make significant purchases like a home or a car. Moreover, carrying substantial debt can lead to stress and anxiety, affecting mental health and overall well-being. The burden of debt can also hinder one’s ability to qualify for additional loans or credit, as lenders often assess an individual’s debt-to-income ratio when making lending decisions.

Understanding the nuances of debt is crucial for anyone looking to secure their financial future and make informed decisions about borrowing and repayment.

Creating a Budget and Cutting Expenses to Tackle Debt

Creating a budget is one of the most effective strategies for managing debt and regaining control over one’s finances. A budget serves as a roadmap that outlines income and expenses, allowing individuals to see where their money is going each month. By tracking spending habits, individuals can identify areas where they may be overspending and make necessary adjustments.

For example, someone who frequently dines out may realize that cooking at home could save them hundreds of dollars each month. This awareness can lead to more mindful spending and ultimately contribute to debt repayment. In addition to creating a budget, cutting unnecessary expenses is essential for tackling debt.

This process often involves making tough choices about lifestyle habits and discretionary spending. For instance, individuals might consider canceling subscription services they rarely use or opting for more affordable entertainment options. Additionally, negotiating bills—such as insurance premiums or utility costs—can yield significant savings.

By prioritizing essential expenses and eliminating non-essential ones, individuals can free up more funds to allocate toward debt repayment, accelerating their journey toward financial freedom.

Exploring Different Debt Repayment Strategies

When it comes to repaying debt, various strategies can be employed, each with its own advantages and disadvantages. One popular method is the “debt snowball” approach, which involves paying off the smallest debts first while making minimum payments on larger debts. This strategy can provide quick wins and boost motivation as individuals see their debts disappearing one by one.

For example, if someone has three debts—$500, $1,500, and $5,000—they would focus on paying off the $500 debt first. Once that is cleared, they would move on to the $1,500 debt, creating a sense of accomplishment that can propel them forward. Alternatively, the “debt avalanche” method focuses on paying off debts with the highest interest rates first.

This approach can save individuals more money in interest payments over time. For instance, if someone has debts of $1,000 at 20% interest and $2,000 at 10% interest, they would prioritize the $1,000 debt due to its higher cost over time. While this method may not provide the same immediate gratification as the snowball approach, it is often more financially advantageous in the long run.

Ultimately, the choice between these strategies depends on individual preferences and financial situations.

Building an Emergency Fund as a Safety Net

| Emergency Fund Metric | Recommended Amount |

|---|---|

| Monthly Expenses | 3-6 times |

| Income Replacement | 3-6 months |

| Emergency Fund Goal | 3-6 months of expenses |

| Emergency Fund Balance | Current savings amount |

An emergency fund is a crucial component of sound financial planning and serves as a safety net during unexpected circumstances such as job loss, medical emergencies, or urgent home repairs. Financial experts typically recommend saving three to six months’ worth of living expenses in an easily accessible account. This fund provides peace of mind and prevents individuals from resorting to high-interest credit cards or loans when faced with unforeseen expenses.

For example, if someone loses their job unexpectedly, having an emergency fund can help cover essential bills while they search for new employment without incurring additional debt. Building an emergency fund requires discipline and commitment but can be achieved through consistent saving habits. Individuals might start by setting aside a small percentage of their income each month specifically for this purpose.

Automating savings transfers to a separate account can also help ensure that funds are allocated consistently without the temptation to spend them elsewhere. Additionally, individuals can consider using windfalls—such as tax refunds or bonuses—to boost their emergency fund more quickly. By prioritizing this financial cushion, individuals can protect themselves from future financial setbacks and reduce reliance on credit during challenging times.

Introduction to Investing: Stocks, Bonds, and Mutual Funds

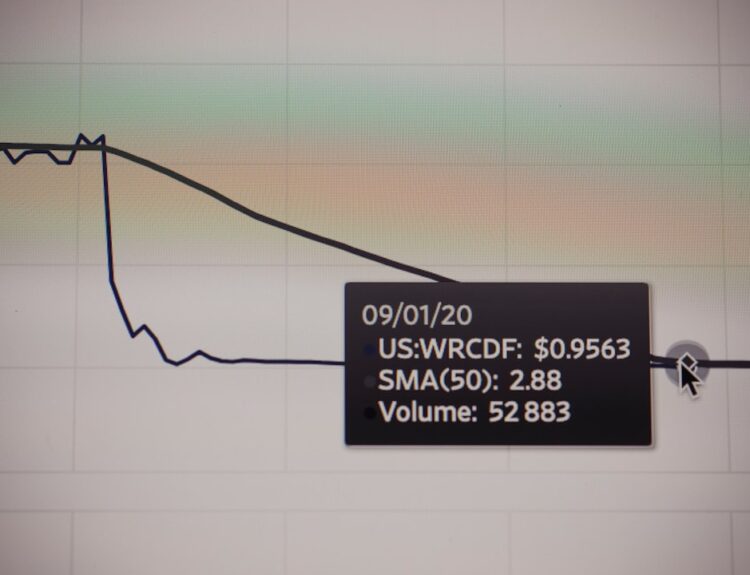

Investing is a powerful tool for building wealth over time and achieving long-term financial goals. At its core, investing involves allocating resources—typically money—into assets with the expectation of generating a return or profit in the future. The most common investment vehicles include stocks, bonds, and mutual funds.

Stocks represent ownership in a company and offer the potential for capital appreciation as well as dividends. For instance, purchasing shares in a technology company could yield significant returns if the company grows and becomes more profitable over time. Bonds are another popular investment option that involves lending money to an entity—such as a corporation or government—in exchange for periodic interest payments and the return of principal at maturity.

Bonds are generally considered less risky than stocks but typically offer lower returns. Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks and bonds managed by professional fund managers. This diversification helps mitigate risk while providing access to a broader range of investment opportunities than an individual investor might achieve alone.

Setting Financial Goals and Creating an Investment Plan

Defining Specific Goals

By defining specific goals—such as “I want to save $500,000 for retirement by age 65″—individuals can create a focused investment plan that aligns with their aspirations. This clarity helps guide investment decisions and provides motivation during market fluctuations.

Creating an Investment Plan

Once financial goals are established, creating an investment plan becomes paramount. This plan should outline the types of investments that will be pursued based on risk tolerance, time horizon, and expected returns. For example, someone with a long time horizon until retirement may choose to invest more heavily in stocks for potential growth, while someone nearing retirement might prioritize bonds for stability and income generation.

Regular Review and Adjustment

Regularly reviewing and adjusting the investment plan in response to changing circumstances or market conditions is also crucial for staying on track toward achieving financial goals.

Understanding Risk and Diversification in Investment

Risk is an inherent aspect of investing; it refers to the potential for loss or underperformance relative to expectations. Different asset classes carry varying levels of risk; for instance, stocks are generally more volatile than bonds but offer higher potential returns over the long term. Understanding one’s risk tolerance—how much risk an individual is willing to accept—is vital when constructing an investment portfolio.

Factors influencing risk tolerance include age, financial situation, investment goals, and personal comfort with market fluctuations. Diversification is a key strategy for managing risk within an investment portfolio. By spreading investments across different asset classes—such as stocks from various sectors or bonds with varying maturities—investors can reduce the impact of poor performance in any single investment on their overall portfolio.

For example, if an investor holds stocks in both technology and healthcare sectors along with government bonds, a downturn in one sector may be offset by stability or growth in another. This balanced approach helps mitigate risk while still allowing for potential growth opportunities.

Seeking Professional Advice and Resources for Investing

Navigating the world of investing can be complex and overwhelming for many individuals; therefore, seeking professional advice can be invaluable. Financial advisors offer expertise in creating personalized investment strategies tailored to individual goals and risk tolerance levels. They can provide insights into market trends, asset allocation strategies, and tax implications that may not be readily apparent to novice investors.

Additionally, advisors can help individuals stay disciplined during market volatility by reminding them of their long-term objectives. In addition to professional advice, numerous resources are available for those looking to enhance their investing knowledge independently. Books on personal finance and investing principles can provide foundational knowledge while online courses offer structured learning opportunities on various topics related to investing.

Websites dedicated to financial education often feature articles, videos, and tools designed to help individuals make informed decisions about their investments. By leveraging both professional guidance and educational resources, investors can build confidence in their ability to navigate the complexities of the financial markets effectively.

FAQs

What is investing?

Investing is the act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit.

Can I start investing if I’m in debt?

Yes, it is possible to start investing even if you are in debt. It’s important to prioritize paying off high-interest debt first, but you can still begin investing with a small amount of money while working on your debt repayment plan.

What are some tips for starting to invest while in debt?

– Prioritize paying off high-interest debt first

– Start with small investments

– Consider low-risk investment options

– Create a budget to manage your finances effectively

What are some low-risk investment options for beginners in debt?

Some low-risk investment options for beginners in debt include:

– Index funds

– Exchange-traded funds (ETFs)

– Treasury securities

– Certificate of deposit (CD)

Should I seek professional financial advice before starting to invest while in debt?

It’s always a good idea to seek professional financial advice before starting to invest, especially if you are in debt. A financial advisor can help you create a personalized investment plan that aligns with your financial goals and debt repayment strategy.