Lifestyle inflation, often referred to as lifestyle creep, is a phenomenon that occurs when individuals increase their spending as their income rises. This can manifest in various ways, such as upgrading to a larger home, purchasing more expensive vehicles, or indulging in luxury vacations. While it is natural to want to enjoy the fruits of one’s labor, unchecked lifestyle inflation can lead to financial instability and a lack of savings.

The core issue lies in the tendency to equate self-worth and happiness with material possessions, which can create a cycle of perpetual spending that outpaces income growth. To illustrate this concept, consider a young professional who receives a significant raise at work. Instead of saving or investing the additional income, they might choose to move into a more expensive apartment, buy a new car, or dine out more frequently.

Over time, these incremental increases in spending can erode any financial gains made from the salary increase. The result is often a situation where the individual finds themselves living paycheck to paycheck, despite earning more than they did previously. Understanding lifestyle inflation is crucial for anyone looking to build wealth and achieve long-term financial stability.

Creating a Budget

Creating a budget is an essential step in managing personal finances effectively. A well-structured budget serves as a roadmap for spending and saving, allowing individuals to allocate their resources in a way that aligns with their financial goals. The first step in creating a budget involves tracking income and expenses over a specific period, typically a month.

This process helps individuals identify spending patterns and areas where they may be overspending. By categorizing expenses into fixed costs, such as rent or mortgage payments, and variable costs, like groceries and entertainment, one can gain a clearer picture of their financial situation. Once the data is collected, the next phase involves setting realistic financial goals.

These goals can range from short-term objectives, such as saving for a vacation, to long-term aspirations like retirement planning. A budget should reflect these goals by allocating funds accordingly. For instance, if an individual aims to save for a down payment on a house, they might decide to cut back on discretionary spending and redirect those funds into a dedicated savings account.

Regularly reviewing and adjusting the budget is also vital, as it allows individuals to adapt to changes in income or expenses and stay on track toward their financial objectives.

Investing in the Future

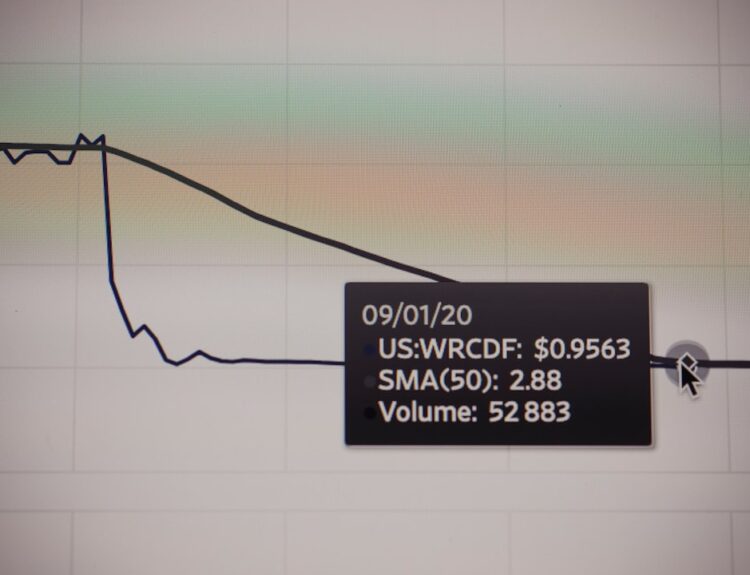

Investing is a critical component of building wealth and securing financial independence. Unlike saving, which typically involves setting aside money in low-interest accounts, investing allows individuals to grow their wealth over time through various asset classes such as stocks, bonds, real estate, and mutual funds. The power of compounding interest plays a significant role in investment growth; even small contributions can accumulate significantly over time if invested wisely.

For example, starting an investment account at a young age can yield substantial returns by the time one reaches retirement age. Moreover, understanding risk tolerance is essential when it comes to investing. Different asset classes come with varying levels of risk and potential return.

For instance, stocks are generally considered riskier than bonds but offer higher potential returns over the long term. Individuals must assess their comfort level with risk and create a diversified investment portfolio that aligns with their financial goals and timelines. Engaging with investment vehicles such as index funds or exchange-traded funds (ETFs) can provide exposure to a broad market while minimizing individual stock risk.

By prioritizing investments early on, individuals can set themselves up for long-term financial success.

Avoiding Impulse Purchases

| Category | Metrics |

|---|---|

| Spending Habits | Number of impulse purchases per month |

| Financial Impact | Amount spent on impulse purchases per month |

| Shopping Behavior | Percentage of unplanned purchases |

| Decision Making | Frequency of regret after impulse purchases |

Impulse purchases can derail even the most carefully crafted budgets and financial plans. These spontaneous buying decisions often stem from emotional triggers rather than necessity, leading individuals to acquire items they do not need or cannot afford. To combat this tendency, it is essential to develop strategies that promote mindful spending.

One effective approach is the 24-hour rule: when tempted by an impulse buy, wait 24 hours before making the purchase decision. This cooling-off period allows individuals to evaluate whether the item is truly necessary or simply an emotional response. Another strategy involves creating a shopping list before heading out to make purchases.

By sticking to this list and avoiding distractions from advertisements or sales promotions, individuals can minimize the likelihood of making unplanned purchases. Additionally, understanding one’s triggers for impulse buying—whether it be stress, boredom, or social pressure—can help in developing healthier coping mechanisms. For instance, if shopping is used as a way to alleviate stress, finding alternative activities such as exercise or hobbies can provide similar emotional relief without the financial consequences.

Reevaluating Financial Goals

Financial goals are not static; they evolve over time based on changes in personal circumstances, priorities, and market conditions. Regularly reevaluating these goals is crucial for maintaining alignment with one’s current situation and aspirations. Life events such as marriage, having children, career changes, or approaching retirement can significantly impact financial objectives.

For example, a young couple may initially prioritize saving for travel but later shift their focus toward saving for their children’s education or purchasing a family home. To effectively reevaluate financial goals, individuals should set aside time periodically—such as annually or biannually—to review their progress and adjust their objectives accordingly. This process may involve assessing current savings rates, investment performance, and overall financial health.

It is also beneficial to seek input from trusted financial advisors who can provide insights into market trends and help refine strategies for achieving revised goals. By staying proactive in this regard, individuals can ensure that their financial plans remain relevant and achievable.

Automating Savings

Automation has become an invaluable tool in personal finance management, particularly when it comes to saving money. By setting up automatic transfers from checking accounts to savings accounts or investment accounts, individuals can ensure that they consistently save without having to think about it actively. This method not only simplifies the savings process but also helps in building wealth over time by making saving a priority rather than an afterthought.

For instance, many employers offer direct deposit options that allow employees to allocate a portion of their paycheck directly into savings or retirement accounts. Additionally, automating savings can help mitigate the temptation to spend money that could otherwise be saved. When funds are automatically transferred out of an account before they can be spent, individuals are less likely to miss them and more likely to stick to their savings goals.

Many banks and financial institutions also offer features that round up purchases to the nearest dollar and transfer the difference into savings accounts—an effortless way to accumulate savings over time without significant lifestyle changes.

Seeking Financial Advice

Navigating personal finance can be complex and overwhelming at times; therefore, seeking professional financial advice can be immensely beneficial. Financial advisors bring expertise and experience that can help individuals make informed decisions about budgeting, investing, retirement planning, and tax strategies. They can provide personalized guidance tailored to one’s unique financial situation and goals.

For example, an advisor might help an individual create a comprehensive retirement plan that considers factors such as expected expenses, desired lifestyle during retirement, and potential sources of income. Moreover, engaging with financial professionals can also provide accountability and motivation for individuals striving to meet their financial objectives. Regular check-ins with an advisor can help keep one on track and encourage proactive adjustments based on changing circumstances or market conditions.

It is essential to choose an advisor who aligns with one’s values and understands personal financial goals; this relationship can significantly enhance one’s ability to achieve long-term financial success.

Practicing Gratitude

Practicing gratitude may seem unrelated to personal finance at first glance; however, it plays a crucial role in fostering a healthy relationship with money. By cultivating an attitude of gratitude for what one already has—rather than focusing on what is lacking—individuals can reduce feelings of dissatisfaction that often lead to unnecessary spending. This mindset shift encourages appreciation for experiences and relationships rather than material possessions, which can ultimately lead to more mindful spending habits.

Incorporating gratitude into daily life can take many forms; keeping a gratitude journal where one lists things they are thankful for each day can reinforce positive thinking patterns. Additionally, expressing gratitude towards others—whether through thank-you notes or verbal acknowledgments—can strengthen relationships and create a supportive community that values shared experiences over consumerism. By embracing gratitude as part of one’s financial journey, individuals can foster contentment and make more intentional choices about how they allocate their resources.

FAQs

What is lifestyle inflation?

Lifestyle inflation refers to the tendency for people to increase their spending as their income rises. This often leads to an increase in the standard of living, which can make it difficult to maintain financial stability.

Why is lifestyle inflation a problem?

Lifestyle inflation can lead to a cycle of constantly needing more money to support an increasingly expensive lifestyle. This can make it difficult to save for the future, pay off debt, or deal with unexpected expenses.

What are some simple ways to avoid lifestyle inflation after a raise?

Some simple ways to avoid lifestyle inflation after a raise include creating a budget and sticking to it, automating savings and investments, avoiding unnecessary debt, and being mindful of spending habits.

How can creating a budget help avoid lifestyle inflation?

Creating a budget can help individuals track their expenses and prioritize their spending. By setting limits on certain categories of spending, individuals can avoid the temptation to increase their spending simply because they have more money coming in.

Why is automating savings and investments important in avoiding lifestyle inflation?

Automating savings and investments ensures that a portion of any raise or increase in income goes towards long-term financial goals, rather than being spent on immediate lifestyle upgrades.

What are some examples of unnecessary debt to avoid in order to prevent lifestyle inflation?

Examples of unnecessary debt to avoid include taking out loans for luxury items, financing a new car when a used one would suffice, and using credit cards for non-essential purchases.

How can being mindful of spending habits help prevent lifestyle inflation?

Being mindful of spending habits involves regularly evaluating purchases and considering whether they align with long-term financial goals. This can help individuals avoid unnecessary expenses and keep lifestyle inflation in check.