Intraday trading and long-term holding represent two distinct approaches to investing in the financial markets, each with its own set of strategies, benefits, and challenges. Intraday trading, often referred to as day trading, involves buying and selling financial instruments within the same trading day. Traders capitalize on short-term price movements, aiming to make quick profits from small fluctuations in stock prices.

This method requires a keen understanding of market dynamics, technical analysis, and a willingness to act swiftly on market signals. The allure of intraday trading lies in its potential for rapid gains, but it also comes with heightened risks and demands a significant time commitment. In contrast, long-term holding is a more patient investment strategy that focuses on acquiring assets with the intention of holding them for an extended period, often years or even decades.

Investors who adopt this approach typically seek to benefit from the overall growth of the market or specific companies over time. Long-term holding is grounded in fundamental analysis, where investors evaluate a company’s financial health, competitive position, and growth prospects. This strategy is often associated with lower transaction costs and reduced stress, as it does not require constant monitoring of market fluctuations.

Understanding the fundamental differences between these two strategies is crucial for investors as they navigate their financial journeys.

Time Horizon and Investment Goals

Intraday Trading: Focus on Immediate Returns

Intraday traders operate on a very short time frame, often executing multiple trades within a single day. Their investment goals are centered around generating immediate returns, which can be reinvested or withdrawn quickly. This approach requires a high level of market engagement and the ability to react promptly to price movements. For instance, a day trader might analyze charts and indicators to identify potential entry and exit points, aiming to capitalize on small price changes that occur throughout the day.

Long-term Investing: A Broader Perspective

On the other hand, long-term investors adopt a much broader perspective regarding their time horizon. They often set investment goals that align with significant life events, such as retirement, purchasing a home, or funding education for children. This strategy allows investors to ride out market volatility and benefit from compounding returns over time. For example, an investor who purchases shares in a well-established company may hold onto those shares for years, benefiting from both capital appreciation and dividends.

Key Differences in Approach

The long-term approach emphasizes patience and discipline, as investors are less concerned with daily price fluctuations and more focused on the overall trajectory of their investments. In contrast, intraday traders are highly engaged with the market and focused on immediate returns. Understanding the differences between these two approaches is essential for investors to make informed decisions about their investment strategies.

Risk and Volatility

Risk and volatility are inherent components of both intraday trading and long-term holding, but they manifest differently in each strategy. Intraday trading is characterized by high volatility, as traders seek to exploit rapid price movements that can occur within minutes or hours. This volatility can lead to substantial gains but also significant losses if trades do not go as planned.

Day traders must employ risk management techniques, such as setting stop-loss orders to limit potential losses and using position sizing to control exposure. The fast-paced nature of intraday trading means that traders must be prepared for sudden market shifts that can impact their positions dramatically. In contrast, long-term investors generally experience lower volatility in their portfolios over time.

While individual stocks may fluctuate significantly in the short term, a diversified portfolio can mitigate some of this risk. Long-term investors often focus on the underlying fundamentals of their investments rather than short-term price movements. They understand that markets can be cyclical and that downturns are often followed by recoveries.

For instance, during economic recessions, long-term investors may see temporary declines in their portfolios but remain confident in the eventual recovery based on historical trends. This perspective allows them to maintain their positions without succumbing to panic selling during turbulent times.

Market Analysis and Decision-Making

| Metrics | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| Market Size | 200,000 | 210,000 | 220,000 | 230,000 |

| Market Growth Rate | 5% | 5% | 5% | 5% |

| Customer Acquisition Cost | 50 | 55 | 60 | 65 |

| Customer Lifetime Value | 500 | 510 | 520 | 530 |

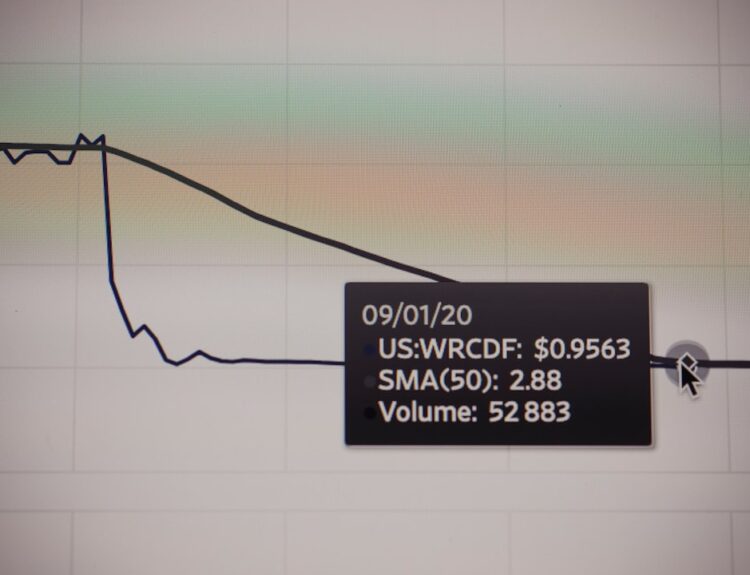

The methods of market analysis employed by intraday traders and long-term investors differ significantly due to their respective time frames and objectives. Intraday traders primarily rely on technical analysis, which involves studying price charts, patterns, and indicators to make quick trading decisions. They may use tools such as moving averages, Relative Strength Index (RSI), and candlestick patterns to identify potential entry and exit points.

For example, a day trader might observe a stock’s price breaking above a key resistance level on high volume, prompting them to enter a position with the expectation that the momentum will continue throughout the day. Conversely, long-term investors focus on fundamental analysis to evaluate the intrinsic value of an asset. This approach involves examining financial statements, industry trends, economic indicators, and company news to make informed investment decisions.

Long-term investors may look for undervalued stocks with strong growth potential or companies with solid dividend histories. For instance, an investor might analyze a company’s earnings growth over several years, its competitive advantages within its industry, and macroeconomic factors that could influence its future performance. This thorough analysis helps long-term investors build a portfolio that aligns with their financial goals while minimizing the impact of short-term market fluctuations.

Psychological Factors and Emotional Discipline

Psychological factors play a significant role in both intraday trading and long-term investing, influencing decision-making processes and overall success. Intraday traders must cultivate emotional discipline to navigate the high-pressure environment of rapid trading. The adrenaline rush associated with quick trades can lead to impulsive decisions driven by fear or greed.

Successful day traders often develop strict trading plans that outline entry and exit strategies, risk management rules, and profit targets. By adhering to these plans, they can mitigate emotional responses that may lead to poor decision-making. Long-term investors also face psychological challenges but in different forms.

The patience required for this strategy can be tested during periods of market downturns or economic uncertainty. Investors may experience anxiety when they see their portfolios decline in value; however, maintaining a long-term perspective is crucial for success. Many long-term investors find it beneficial to periodically review their investment thesis and remind themselves of their original goals.

This practice helps reinforce their commitment to their strategy and reduces the likelihood of making impulsive decisions based on short-term market noise.

Tax Implications

Tax implications are an essential consideration for both intraday traders and long-term investors, as they can significantly impact overall returns. Intraday trading is often subject to higher tax rates due to the frequency of trades and the nature of capital gains realized. In many jurisdictions, profits from trades held for less than a year are taxed as short-term capital gains, which are typically taxed at ordinary income tax rates.

This can result in a substantial tax burden for active traders who generate significant profits through frequent buying and selling. In contrast, long-term investors benefit from favorable tax treatment on capital gains realized from assets held for more than one year. Many tax systems offer lower rates for long-term capital gains compared to short-term gains, incentivizing investors to hold onto their investments for extended periods.

Additionally, long-term investors may also benefit from tax-deferred accounts such as IRAs or 401(k)s in the United States, where taxes on capital gains are postponed until withdrawals are made during retirement. Understanding these tax implications is crucial for both strategies as they can influence net returns and overall investment performance.

Costs and Fees

The costs associated with intraday trading and long-term holding can vary significantly based on the frequency of transactions and the types of accounts used for trading. Intraday traders often incur higher transaction costs due to the volume of trades executed daily. Brokerage commissions, spreads between bid and ask prices, and potential fees for real-time data access can add up quickly for active traders.

Some brokers offer commission-free trading; however, hidden costs such as wider spreads can still impact profitability. Long-term investors typically face lower transaction costs since they trade less frequently. While there may still be brokerage fees associated with buying or selling assets, these costs are amortized over a longer investment horizon.

Additionally, long-term investors may choose low-cost index funds or exchange-traded funds (ETFs) that have lower expense ratios compared to actively managed funds. By minimizing costs through strategic investment choices, long-term investors can enhance their overall returns over time.

Choosing the Right Strategy for You

Selecting between intraday trading and long-term holding ultimately depends on individual preferences, risk tolerance, investment goals, and lifestyle considerations. Intraday trading may appeal to those who thrive in fast-paced environments and possess strong analytical skills coupled with emotional discipline. Conversely, long-term holding may be more suitable for individuals seeking stability and willing to adopt a patient approach toward wealth accumulation.

Understanding the nuances of each strategy is essential for making informed decisions that align with personal financial objectives. Whether one chooses the excitement of intraday trading or the steadiness of long-term investing, it is crucial to remain committed to ongoing education and self-improvement within the chosen strategy. Each path offers unique opportunities for growth; thus, aligning one’s approach with personal values and circumstances will ultimately lead to greater satisfaction in the investment journey.

FAQs

What is Intraday Trading?

Intraday trading refers to buying and selling of stocks or other financial instruments within the same trading day. Traders aim to take advantage of small price movements and make quick profits.

What is Long-Term Holding?

Long-term holding, also known as buy-and-hold strategy, involves buying and holding onto investments for an extended period, typically years. This strategy is based on the belief that the value of the investment will increase over time.

What are the key differences between Intraday Trading and Long-Term Holding?

The key differences between the two strategies include the time horizon, risk level, and trading frequency. Intraday trading involves short-term trading with high frequency and higher risk, while long-term holding involves a longer time horizon with lower frequency and lower risk.

Which strategy is more suitable for beginners?

Long-term holding is generally considered more suitable for beginners as it requires less active monitoring and is less susceptible to short-term market fluctuations. Intraday trading requires a higher level of skill, experience, and understanding of market dynamics.

Which strategy is more suitable for risk-averse investors?

Long-term holding is more suitable for risk-averse investors as it allows for a more passive approach to investing and reduces the impact of short-term market volatility. Intraday trading involves higher risk and requires a higher tolerance for market fluctuations.